- What we offer

- Who we serve

- Digital Transformation

- Our Approach

- Careers

- About Us

- Insights

- Contact Us

IntelliQuest is an assortment of pioneering tech solutions that leverage the power of AI and ML, merging industry expertise with advanced digital capabilities to revolutionize operations. By seamlessly automating processes, it enhances operational effectiveness, accelerates turnaround times, and bolsters throughput. Whether it’s AI-driven financial statement analysis, ML-powered rent roll analysis, property/market research, email box management, code violation monitoring or broker/originator and insurance support, IntelliQuest offers a comprehensive suite of automated tools that integrates every facet of the mortgage cycle and provides a unified platform to cover all the critical aspects.

IntelliReader is an advanced solution that transforms typed, scanned, printed or handwritten…

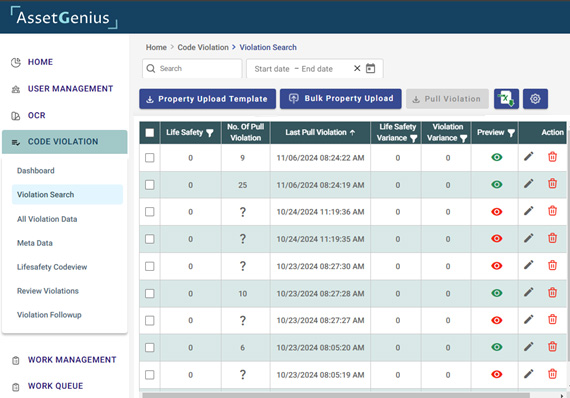

This tool impeccably sources Building Code Violations for the properties, ensuring regulatory compliance and streamlines…

LoanCraft is a loan sizing and underwriting tool that analyzes financial and rent roll documents to better manage…

DrawCompass is a draw processing and servicing digital application designed to streamline construction draw…

DocAbstract is a data abstraction tool built for CRE professionals. It extracts, structures, and reconciles critical data from third-party…

LeaseGenie is an AI-powered automation digital application that abstracts critical financial and non-financial information…

LoanIQ is a digital platform that simplifies the onboarding of commercial real estate (CRE) loans. It standardizes ticket creation…

Facilitates quicker data retrieval, reduces manual data entry efforts, saves time and resources.

Converting scanned documents into searchable and editable digital formats enables rapid document processing.

Minimizes errors associated with manual transcription, ensuring high-quality data output.

Automating repetitive tasks and reducing manual labor helps lower operational costs.

Scalable & capable of handling large volumes of documents efficiently. This scalability ensures consistent processing speed and accuracy even when dealing with diverse document types and formats.

Enhances document accessibility by making content editable, searchable and retrievable. This accessibility ensures that users can quickly locate specific information within documents, facilitating faster decision-making and response times.

Building code violations can be sourced for multiple buildings within the same property.

Violations are accurately segregated between Life Safety and Other Violations.

Historical tracking helps identify Recurring/Unresolved Violations.

User-friendly and comprehensive dashboards facilitate crisp analysis in the shortest time.

Asset Managers can achieve timely closure through regular monitoring of “Open Violations” Tracks Open Building Code Violations.

Reduce administrative burden with automation and decreases the likelihood of errors thus affording more time for strategic activities.

Powerful tool to streamline the distribution and management of cases.

Capable of handling large volumes of documents, making it suitable for organizations of all sizes.

Lowers operational costs by automating the document digitization process.

Cases are instantly assigned to the most appropriate team members based on specific criteria such as product interest and priority.

Targeted approach to accelerate response time to increase customer satisfaction.

Strategic advantage for businesses looking to support workflow, ultimately driving growth and customer loyalty.

Financials & Rent Roll can be spread and analyzed much more quickly with ~60% time savings.

Informative Dashboard enables analysis on various critical parameters.

Time Savings per analysis translate into greater capacity to manage spikes.

Audit feature enables identification of discrepancies at an early stage for accurate analysis.

The tool triggers automated emails to the various stakeholders thus enabling better coordination.

Manual data entry is significantly reduced through OCR automation and reuse of historical mappings. Analysts focus only on flagged discrepancies instead of reviewing every document line by line.

Built-in document completeness checks, budget validations, and duplicate invoice detection reduce compliance risks and prevent overpayments. Every decision is logged with a complete audit trail.

Structured workflows and consolidated review views enable faster turnaround without increasing headcount. Reviewers operate on validated summaries rather than raw document sets.

Each processed draw strengthens vendor intelligence, budget accuracy, and invoice matching, improving data quality and reducing errors over time.

Sources critical data across multiple third-party reports in seconds instead of hours, offering up to 85% time savings.

Ensures consistent data extraction with 99% accuracy across all reports with no human variability.

Clear visibility into variances and final approved values.

Actionable data available early in the credit process.

Handles volume spikes efficiently without scaling headcount.

Increased efficiency and accuracy with consistent output results in higher cost savings.

Technology augmented with desired level of human intervention ensures data accuracy without compromising compliance.

Improved operational efficiency and streamlined workflow system ensure quicker turnaround and faster decision making.

OCR and templates significantly reduce analyst data entry work

Standard CRE loans boarded within hours instead of days

Validation rules and reviewer controls minimize errors

Uniform process across portfolios and teams

Teams handle more loans with the same capacity

Privacy Ensuring privacy through robust access control measures, two-factor authentication, & encryption, safeguarding sensitive data from unauthorized access.

Availability Ensuring availability through performance monitoring, disaster recovery protocols, & efficient security incident handling, minimizing downtime and ensuring continuous operations.

Security Enhancing security with network/application firewalls, intrusion detection systems, and two-factor authentication, fortifying defenses against cyber threats.

Processing Integrity Ensuring processing integrity through quality assurance measures and continuous monitoring, maintaining the accuracy and reliability of data processing operations.

Confidentiality Upholding confidentiality through encryption and access control mechanisms, maintaining the integrity of sensitive information.

Please fill the details below. A representative will contact you shortly after receiving your request.